Mutual funds are an ideal investment vehicle for regular investors who do not know much about investing. Investors can choose a mutual fund scheme based on their financial goal and start investing to achieve the goal.

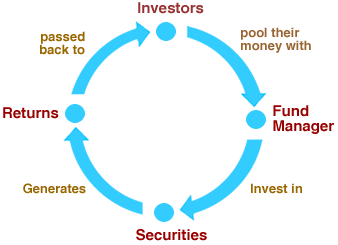

A mutual fund collects money from investors and invests the money in equities, bonds and other securities, on their behalf. It charges a small fee for managing the money.